Started with Federal Mining Reform

The Idaho Abandoned Mine Reclamation Act (Act), Idaho Code 47–1703, was passed during the 1994 Legislative Session in anticipation of federal mining law reform. This anticipated reform would have resulted in the states receiving money for abandoned mine reclamation from the federal government. Idaho’s Act created a place for money to go, and it set certain guidelines for how the money would be spent. Federal Mining Law reform, however, never occurred, and Idaho’s Abandoned Mine Reclamation Fund (Fund) remained empty.

Idaho's Solution for Abandoned Mines

In 1999 the State Legislature amended the Abandoned Mine Reclamation Act and laws pertaining to the Mine License Tax to create a permanent revenue source to pay for abandoned mine reclamation. This statutory change was proposed and supported largely by the Idaho Mining Association.

As a result, 34% of the State’s Mine License Tax was diverted from the General Fund into the Abandoned Mine Reclamation Fund.

In 2001 the Legislature reduced the mine license tax from 2% to 1%. The fiscal note attached to House Bill 174 predicted the change would reduce both General Fund and Abandoned Mine Land Fund receipts. Given unanticipated decreases in future mine license tax revenue, this change unintentionally helped set the stage to lead the Abandoned Mine Land Reclamation Fund towards insolvency.

Mine License Tax Revenue

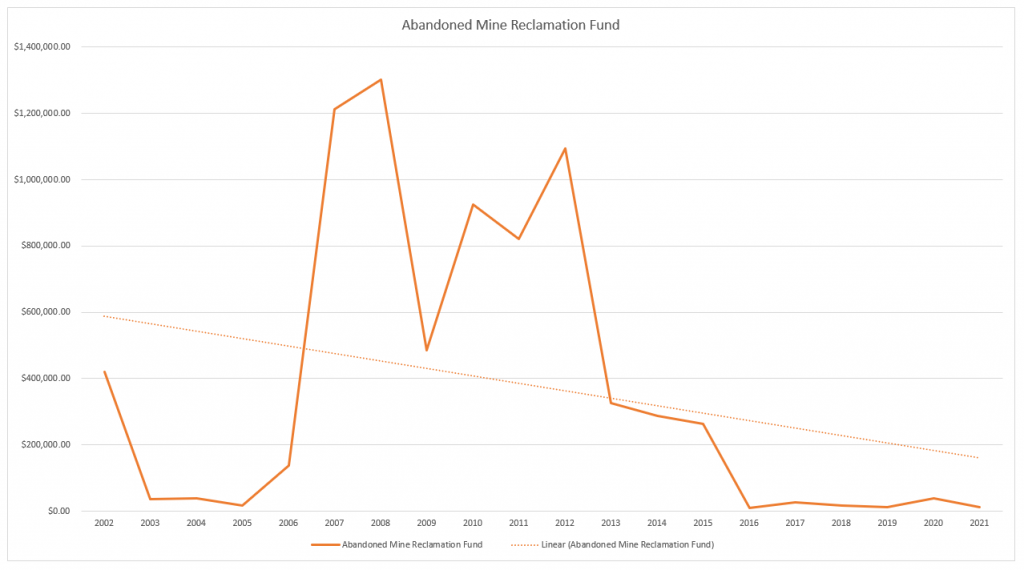

Over time, revenue from the Mine License Tax has been highly variable, following a cyclical boom and bust pattern. While revenue generated by the Mine License Tax has, on average, exceeded amounts estimated in 1999, collections since 2012 have been less that the amount estimated in 1999.

Since 2016, revenue collected from the tax has plummeted. On Average, since 2016 the average receipts deposited into the Abandoned Mine Reclamation Fund have fallen to below $20,000 each year.

As a result of the precipitous funding decline, IDL forecast that the Abandoned Mine Reclamation Fund will become insolvent in 2027 unless alternative sources of funding are implemented.

| Fiscal Year | Mine License Tax Total Revenue | Abandoned Mine Reclamation Fund (34% of Total Revenue) |

| 2002 | $1,236,740 | $420,492 |

| 2003 | $107,239 | $36,461 |

| 2004 | $115,263 | $39,189 |

| 2005 | $53,188 | $18,084 |

| 2006 | $404,811 | $137,636 |

| 2007 | $3,569,792 | $1,213,729 |

| 2008 | $3,829,532 | $1,302,041 |

| 2009 | $1,430,032 | $486,211 |

| 2010 | $2,723,273 | $925,913 |

| 2011 | $2,417,791 | $822,049 |

| 2012 | $3,220,445 | $1,094,951 |

| 2013 | $959,166 | $326,116 |

| 2014 | $842,686 | $286,513 |

| 2015 | $775,935 | $263,818 |

| 2016 | $30,847 | $10,488 |

| 2017 | $75,833 | $25,783 |

| 2018 | $52,493 | $17,848 |

| 2019 | $34,556 | $11,749 |

| 2020 | $116,862 | $39,733 |

| 2021 | $36,322 | $12,349 |

Land Board Direction to Find a Solution

Well aware that the Abandoned Mine Reclamation Fund was becoming depleted, the Land Board directed IDL to identify potential solutions address declining revenues and increasing costs. On October 19, 2021, IDL presented its findings to the Board, highlighting historical funding fluctuations and options for securing adequate funding.